S-1/A: General form of registration statement for all companies including face-amount certificate companies

Published on September 27, 2024

Table of Contents

As filed with the Securities and Exchange Commission on September 27, 2024

Registration No. 333-281992

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

StandardAero, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 3724 | 30-1138150 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

6710 North Scottsdale Road, Suite 250

Scottsdale, AZ 85253

(480) 377 3100

(Address, including zip code, and telephone number, including area code, of registrants principal executive offices)

Steve Sinquefield

Senior Vice President and General Counsel

6710 North Scottsdale Road, Suite 250

Scottsdale, AZ 85253

(480) 377 3100

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies to: | ||

| Patrick H. Shannon Jason M. Licht Christopher M. Bezeg Latham & Watkins LLP 555 11th Street, NW Washington, DC 20004 (202) 637-2200 |

Rod Miller Lesley Janzen Milbank LLP 55 Hudson Yards New York, NY 10001 (212) 530-5000 |

|

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of large accelerated filer, accelerated filer, smaller reporting company, and emerging growth company in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We and the selling stockholders may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and we and the selling stockholders are not soliciting offers to buy the securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 27, 2024.

60,000,000 Shares

StandardAero, Inc.

Common Stock

This is StandardAero, Inc.s initial public offering. We are selling 53,250,000 shares of our common stock in this offering. The selling stockholders named in this prospectus are selling 6,750,000 shares of our common stock in this offering.

Prior to this offering, there has been no public market for our common stock. The initial public offering price is expected to be between $20.00 and $23.00 per share. After pricing of the offering, we expect that our common stock will trade on the New York Stock Exchange (NYSE) under the symbol SARO.

After the consummation of this offering, we expect to be a controlled company within the meaning of the corporate governance standards of the NYSE.

Investing in our common stock involves risk. See Risk Factors beginning on page 21 to read about factors you should consider before buying shares of our common stock.

| Per Share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| Proceeds to selling stockholders |

$ | $ | ||||||

| (1) | See Underwriting (Conflicts of Interest) for a description of the compensation payable to the underwriters. |

This is a firm commitment underwritten offering. The underwriters may also exercise their option to purchase up to an additional 9,000,000 shares from the selling stockholders, at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus to cover sales of additional shares by the underwriters. We will not receive any proceeds from the sale of the shares by the selling stockholders. The selling stockholders named in this prospectus are affiliates of The Carlyle Group Inc. and GIC Private Limited.

Certain funds and accounts managed by Blackrock, Inc., Janus Henderson Investors and Norges Bank Investment Management, a division of Norges Bank (the cornerstone investors), have, severally and not jointly, indicated an interest in purchasing up to an aggregate of $275 million in shares of our common stock in this offering at the initial public offering price. The shares to be purchased by the cornerstone investors will not be subject to a lock-up agreement with the underwriters. Because this indication of interest is not a binding agreement or commitment to purchase, the cornerstone investors may determine to purchase more, less or no shares in this offering or the underwriters may determine to sell more, less or no shares to the cornerstone investors. The underwriters will receive the same discount on any of our shares of common stock purchased by the cornerstone investors as they will from any other shares sold to the public in this offering.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Delivery of the shares of common stock will be made on or about , 2024.

Joint Bookrunning Managers

| J.P. Morgan* | Morgan Stanley* |

* listed in alphabetical order

| BofA Securities | UBS Investment Bank | Jefferies | RBC Capital Markets |

| Carlyle |

CIBC Capital Markets |

HSBC | Mizuho | SOCIETE GENERALE |

Wolfe | Nomura Alliance |

Co-Managers

| Citizens JMP | Macquarie Capital | Santander |

| Amerivet Securities | Drexel Hamilton |

The date of this prospectus is , 2024.

Table of Contents

Table of Contents

| Page | ||||

| ii | ||||

| iv | ||||

| iv | ||||

| v | ||||

| 1 | ||||

| 21 | ||||

| 61 | ||||

| 63 | ||||

| 64 | ||||

| 65 | ||||

| 67 | ||||

| MANAGEMENTS DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

69 | |||

| 96 | ||||

| 114 | ||||

| 122 | ||||

| 141 | ||||

| 144 | ||||

| 148 | ||||

| 154 | ||||

| 162 | ||||

| MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES TO NON-U.S. HOLDERS |

164 | |||

| 168 | ||||

| 179 | ||||

| 179 | ||||

| 179 | ||||

| F-1 | ||||

i

Table of Contents

Through and including , 2024 (the 25th day after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers obligation to deliver a prospectus when acting as an underwriter and with respect to unsold allotments or subscriptions.

Neither we, the selling stockholders nor any of the underwriters have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. Neither we, the selling stockholders nor any of the underwriters take any responsibility for, and can provide no assurance as to the reliability of, any other information that others may provide you. We, the selling stockholders and the underwriters are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business, financial condition, results of operations and future growth prospects may have changed since that date.

For investors outside the United States: No action is being taken in any jurisdiction outside the United States to permit a public offering of common stock or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restriction as to this offering and the distribution of this prospectus applicable to those jurisdictions.

We manage our business in line with our service offerings with our reportable segments being Engine Services and Component Repair Services. Our Engine Services segment provides a full suite of aftermarket services, including maintenance, repair and overhaul, on-wing and field service support, asset management, and engineering and related solutions primarily in support of gas turbine engines across the commercial aerospace, military and helicopter, and business aviation end markets. Our Component Repair Services segment supports the commercial aerospace, military and other end markets with engine piece part component and accessory repair, as well as some engine new part manufacturing.

On September 5, 2024, we changed our name from Dynasty Parent Co., Inc. to StandardAero, Inc. The audited consolidated financial statements as well as the unaudited condensed interim consolidated financial statements of Dynasty Parent Co., Inc. included elsewhere in this prospectus represent 100% of the business and operations of the newly renamed entity - StandardAero, Inc.

In connection with and prior to the completion of this offering, we and our immediate parent, Dynasty Parent Holdings, L.P., will effect the Restructuring Transactions, which are described in the section titled Prospectus SummaryCorporate Structure and Restructuring Transactions.

Unless the context otherwise requires or we otherwise state, references in this prospectus to:

| | the term 2023 Term B-1 Loan Facility refers to the senior secured dollar term loan B facility in an original aggregate principal amount of $1,802.5 million, as defined in Description of Certain Indebtedness; |

| | the term 2023 Term B-1 Loans refers to the senior secured dollar term loans incurred under the 2023 Term B-1 Loan Facility by Dynasty Acquisition pursuant to the Credit Agreement, as defined in Description of Certain Indebtedness; |

| | the term 2023 Term B-2 Loan Facility refers to the senior secured dollar term loan B facility in an original aggregate principal amount of $772.5 million, as defined in Description of Certain Indebtedness; |

| | the term 2023 Term B-2 Loans refers to the senior secured dollar term loans incurred under the 2023 Term B-2 Loan Facility by the Canadian Borrower, pursuant to the Credit Agreement, as defined in Description of Certain Indebtedness; |

ii

Table of Contents

| | the term 2023 Term Loan Facilities refers, collectively, to (i) the 2023 Term B-1 Loan Facility and (ii) the 2023 Term B-2 Loan Facility; |

| | the term 2023 Term Loans refers, collectively, to (i) the 2023 Term B-1 Loans and (ii) the 2023 Term B-2 Loans; |

| | the term 2023 Revolving Credit Facility refers to the senior secured multicurrency revolving credit facility in an aggregate principal amount of up to $150.0 million (of which up to $75.0 million is available for the issuance of letters of credit), as defined in Description of Certain Indebtedness; |

| | the term 2024 Term B-1 Loan Facility refers to the senior secured dollar term loan B facility in an original aggregate principal amount of approximately $1,993.5 million, as defined in Description of Certain Indebtedness; |

| | the term 2024 Term Loan B-2 Facility refers to the senior secured dollar term loan B facility in an original aggregate principal amount of approximately $768.6 million, as defined in Description of Certain Indebtedness; |

| | the term 2024 Term Loan Facilities refers collectively to the 2024 Term B-1 Loan Facility and the 2024 Term Loan B-2 Facility; |

| | the term ABL Credit Agreement refers to that certain ABL Credit Agreement (as amended, restated, modified and/or supplemented from time to time), dated as of April 4, 2019, governing the ABL Credit Facility; |

| | the term ABL Credit Facility refers to the senior secured asset based multicurrency revolving credit facilities in an aggregate principal amount of up to $400.0 million, as defined in Description of Certain Indebtedness; |

| | the term Acquisition refers to the acquisition by Dynasty Acquisition Co., Inc., pursuant to that certain stock purchase agreement as amended, restated, supplemented or otherwise modified from time to time, dated December 18, 2018 (the Acquisition Agreement), of all of the equity interests of StandardAero Holding Corp., a Delaware corporation; |

| | the term CAGR refers to compound annual growth rate; |

| | the term Canadian Borrower refers to Standard Aero Limited Standaero Limitee (as successor in interest to 1199169 B.C. Unlimited Liability Company) that is the indirect wholly owned subsidiary of the Company; |

| | the term Carlyle refers to those certain investment funds of The Carlyle Group Inc. and its affiliates, as described under Prospectus SummaryOur Principal Stockholders; |

| | the term Carlyle Partners VII refers to Carlyle Partners VII S1 Holdings II, L.P.; |

| | the term Credit Agreement refers to that certain Credit Agreement (as amended, restated, modified and/or supplemented from time to time), dated as of April 4, 2019, governing the Credit Facilities; |

| | the term Credit Facilities refers, collectively, to (i) the 2024 Term Loan Facilities and (ii) the 2023 Revolving Credit Facility; |

| | the term Dynasty Acquisition refers to Dynasty Acquisition Co., Inc., a Delaware corporation that is the indirect wholly owned subsidiary of the Company; |

| | the term Exchange Act refers to the U.S. Securities and Exchange Act of 1934, as amended; |

| | the term GAAP refers to the generally accepted accounting principles in the United States; |

| | the term GIC refers to GIC Private Limited; |

| | the term GIC Investor refers to Hux Investment Ptd Ltd.; |

iii

Table of Contents

| | the term Indenture refers to that certain indenture (as amended, restated, modified and/or supplemented from time to time), dated as of April 4, 2019, by and among Dynasty Acquisition, as issuer, the guarantors party thereto and U.S. Bank National Association, as trustee, governing the Senior Notes; |

| | the term Restructuring Transactions refers to those certain restructuring transactions to be effected in connection with and prior to the completion of this offering, as described under Prospectus SummaryCorporate Structure and Restructuring Transactions; |

| | the term SEC refers to the U.S. Securities and Exchange Commission; |

| | the term Securities Act refers to the U.S. Securities Act of 1933, as amended; |

| | the term selling stockholders refers to Carlyle Partners VII and the GIC Investor; |

| | the term Senior Notes refers to the $475.5 million aggregate principal amount of outstanding Senior Unsecured PIK Toggle Notes due 2027 issued by Dynasty Acquisition pursuant to the Indenture; |

| | the term Senior Secured Credit Agreements refers, collectively, to (i) the Credit Agreement and (ii) the ABL Credit Agreement; |

| | the term Senior Secured Credit Facilities refers, collectively, to (i) the Credit Facilities and (ii) the ABL Credit Facility; |

| | the term Stockholders Agreement refers to the stockholders agreement to be effective upon the consummation of this offering and to be entered into by and among Carlyle Partners VII, the GIC Investor, certain of our other existing stockholders and the Company; and |

| | the terms we, us, our, its and the Company refer to StandardAero, Inc., a Delaware corporation, and its consolidated subsidiaries. |

Certain monetary amounts, percentages and other figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables and charts may not be the arithmetic aggregation of the figures that precede them, and figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

Unless otherwise indicated, information contained in this prospectus concerning our industry, competitive position and the markets in which we operate is based on information from independent industry and research organizations, other third-party sources and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and other third-party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data, and our experience in, and knowledge of, such industry and markets, which we believe to be reasonable. In addition, projections, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors, including those described in Risk Factors and Cautionary Note Regarding Forward-Looking Statements. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

We own or otherwise have rights to the trademarks, service marks and trade names, including those mentioned in this prospectus, that we use in connection with the operation of our business. This prospectus includes trademarks which are protected under applicable intellectual property laws and are our property and/or the property of our subsidiaries. This prospectus also contains trademarks, service marks and trade names of

iv

Table of Contents

other companies, which are, to our knowledge, the property of their respective owners. We do not intend our use or display of other companies trademarks, service marks or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies. Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus may appear without the ® and symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, service marks and trade names.

We present Adjusted EBITDA and Adjusted EBITDA Margin in this prospectus because we believe such measures provide investors with additional information to measure our performance. Please refer to Managements Discussion and Analysis of Financial Condition and Results of OperationsKey Performance Indicators and Non-GAAP Financial Measures for an explanation on why we use these non-GAAP financial measures, their definitions, their limitations and reconciliations to their nearest GAAP financial measures.

Because of their limitations, these non-GAAP financial measures are not intended as alternatives to GAAP financial measures as indicators of our operating performance and should not be considered as measures of cash available to us to invest in the growth of our business or that will be available to us to meet our obligations. We compensate for these limitations by using these non-GAAP financial measures along with other comparative tools, together with GAAP financial measures, to assist in the evaluation of operating performance.

v

Table of Contents

This summary highlights information contained in greater detail elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our common stock, you should carefully read this entire prospectus, including our financial statements and the related notes included elsewhere in this prospectus, and the information set forth under Risk Factors, Cautionary Note Regarding Forward-Looking Statements and Managements Discussion and Analysis of Financial Condition and Results of Operations.

StandardAero A Global Leader in the Highly Attractive Aerospace Engine Aftermarket Sector

We believe that we are the worlds largest independent, pure-play provider of aerospace engine aftermarket services for fixed and rotary wing aircraft, serving the commercial, military and business aviation end markets. We provide a comprehensive suite of critical, value-added aftermarket solutions, including scheduled and unscheduled engine maintenance, repair and overhaul, engine component repair, on-wing and field service support, asset management and engineering solutions. We serve a crucial role in the engine aftermarket value chain, connecting engine original equipment manufacturers (OEMs) with aircraft operators through our aftermarket services, maintaining longstanding relationships with both. We command a leading reputation that is based upon our strong track record of safety, reliability and operational performance built over our more than 100 years of successful operations in the aerospace aftermarket.

Our business consists of an attractive mix of end markets, customers and engine platforms. Our revenue is highly diversified across the commercial, military and business aviation end markets. We believe this diversification provides us with significant resiliency, while affording us the ability to take advantage of new business opportunities that arise. In addition, diversification across engine OEMs and platforms reduces our exposure to idiosyncratic events that may impact demand related to a specific aircraft or engine type.

Within our markets, we hold leadership positions on most of the engine platforms we serve, with an estimated 80% of our Engine Services sales in 2023 from engine platforms where we hold #1 or #2 positions globally. Our platform portfolio consists of a healthy mix of mature, growth and next generation programs and includes many of the engines that power the worlds most prevalent aircraft. For example, we provide support for the CFM56, which powers the Boeing 737NG and Airbus A320ceo family narrowbody aircraft and currently has the largest installed base of any engine platform, the LEAP-1A/-1B, which power the next generation of narrowbody aircraft and are expected to become the most widely fielded platform family in the world by the early 2030s, and the CF34, which powers many of the worlds most utilized regional jets. On several platforms, we hold contracts directly with the OEM that designates us as the primary or sole outsourced provider of maintenance services for the engine. Furthermore, with approximately 77% of our revenue in the year ended December 31, 2023 derived from long-term contractual agreements, our financial profile is characterized by a significant amount of predictable, recurring revenue supported by the highly regulated nature of aircraft engine maintenance requirements.

1

Table of Contents

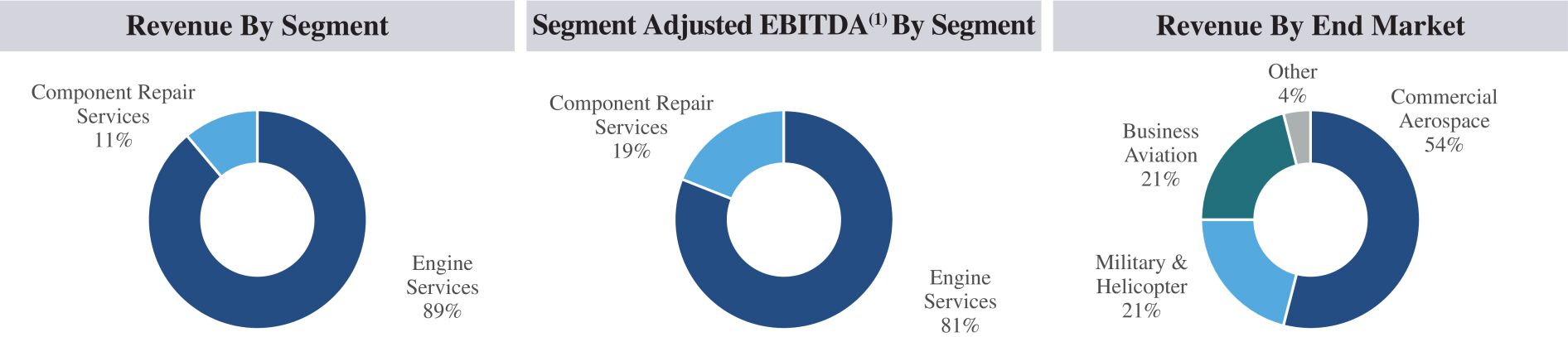

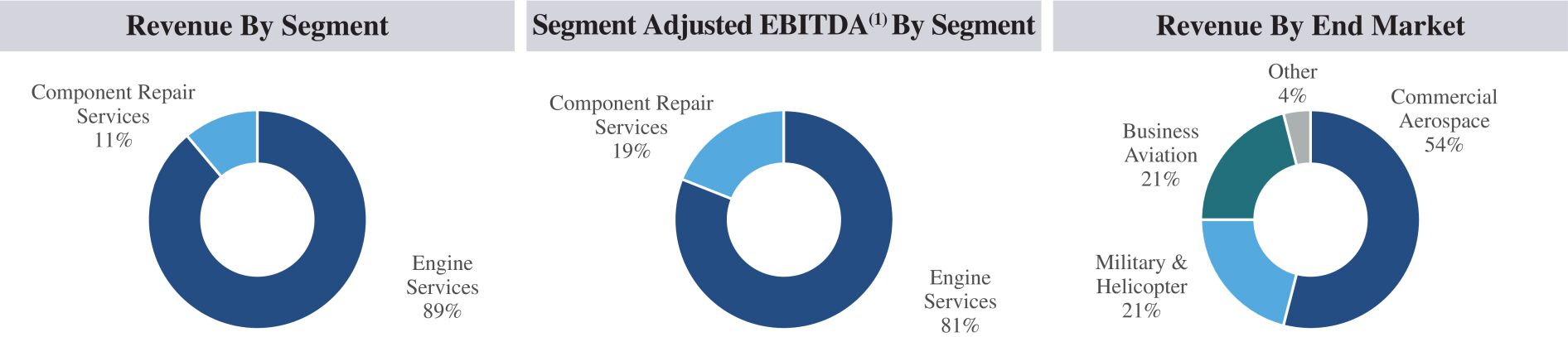

We are also one of the largest independent engine component repair platforms globally, providing services to commercial aerospace, military, land and marine and oil and gas end markets. We have made substantial investments in our Component Repair Services business, which provides attractive margins, significant growth opportunities and synergies with our Engine Services business. The following charts detail our business mix for the year ended December 31, 2023:

| (1) | For a discussion of Segment Adjusted EBITDA, see Managements Discussion and Analysis of Financial Condition and Results of Operations Segment Results and Note 24 and Note 18, Segment information to our audited consolidated financial statements and unaudited condensed interim consolidated financial statements, respectively, included elsewhere in this prospectus. |

Core to our strategy is our positioning as an OEM-aligned and independent service provider of aftermarket services. Our OEM-aligned strategy, coupled with our scale and service performance, entrenches us as a trusted and preferred partner to every major OEM, including GE Aerospace, CFM International, Pratt & Whitney, Rolls-Royce, Honeywell and Safran. We hold long-term OEM licenses and authorizations to provide aftermarket support for all of the engine platforms that we service, and we believe we have a 100% historical success rate on the OEM licenses and authorizations we sought to retain upon their expiration. Our status as an independent services provider, not affiliated with any single OEM or airline operator, provides us with diversification and enhances the value proposition that we can offer to customers. These factors are critical drivers of our ability to cultivate decades-long relationships with many of our approximately 5,000 customers globally.

The engine aftermarket solutions we provide are mission-critical to our customers flight operations and our OEM partners businesses. Furthermore, aerospace engine maintenance is highly specialized and requires significant investment over years to obtain the necessary infrastructure, tooling and skilled engineering expertise. New entrants must obtain extensive approvals and certifications from government regulators and OEMs, who award licenses and authorizations for each engine platform separately. As of June 30, 2024, we operate with OEM licenses and authorizations to perform critical maintenance and overhaul work on over 40 key engine platforms. These licenses and authorizations typically provide us with preferred access to OEM parts and technical information, OEM warranty support and use of the OEM name in marketing and create the foundation for the sharing of closely guarded intellectual property as well as market and customer insights.

2

Table of Contents

The following table summarizes select key customers and platforms across our businesses:

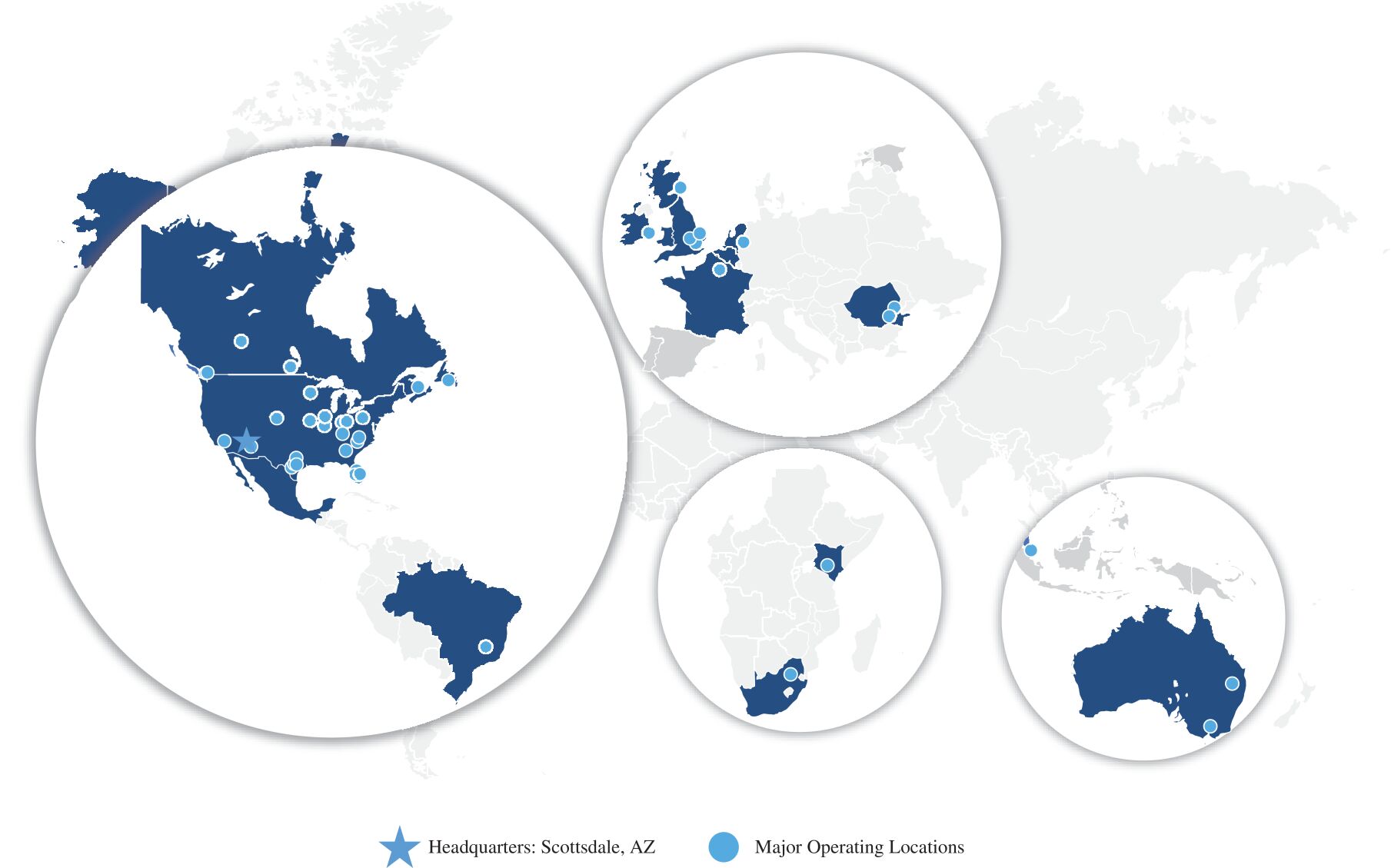

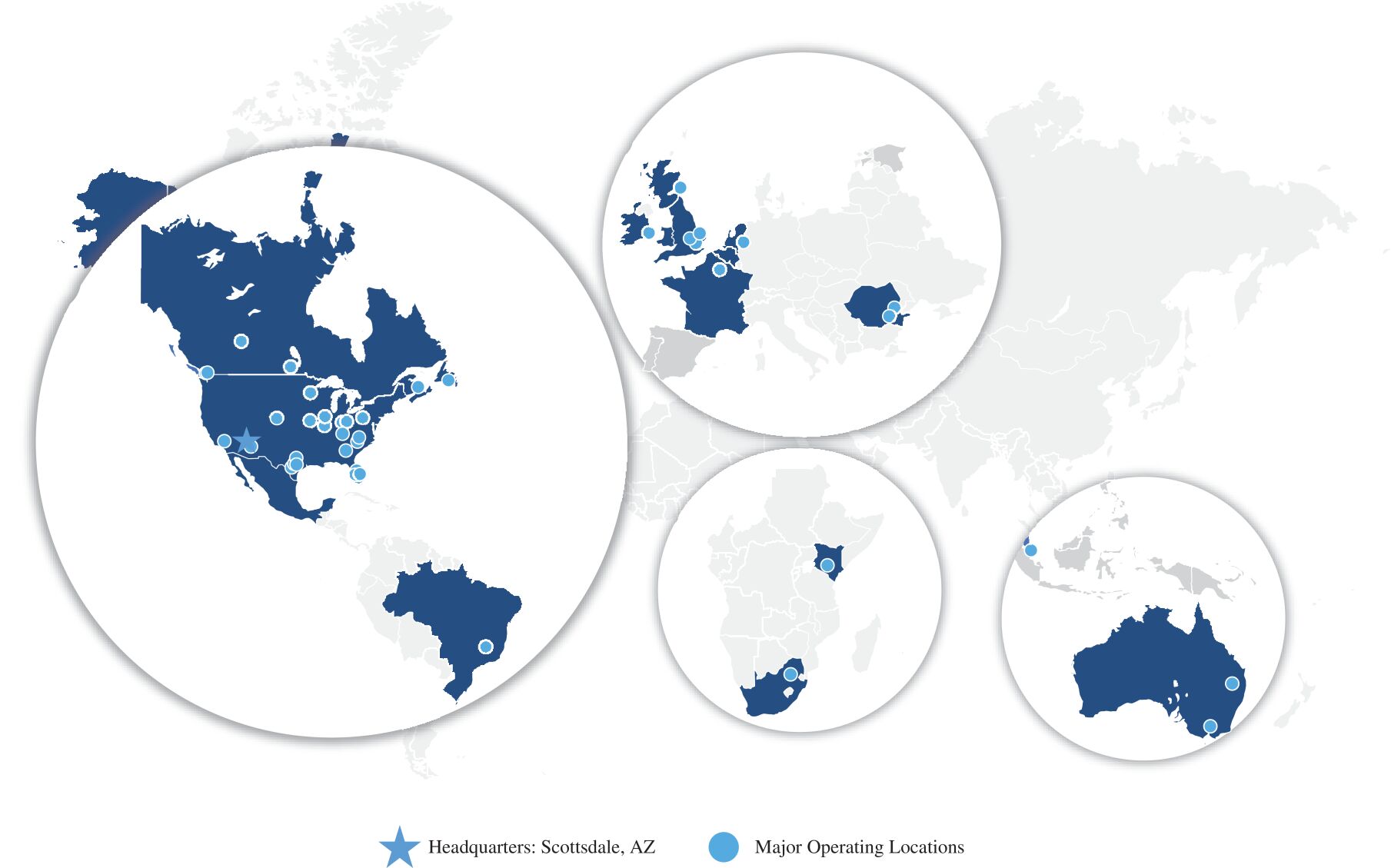

As of June 30, 2024, we employed approximately 7,300 people across over 50 facilities around the globe. We believe our scaled, global footprint is well-aligned to the global nature of our OEM partners and aircraft operator customers and positions us well to win business and support growing global demand for our aerospace engine maintenance services.

3

Table of Contents

The following map details our facilities and highlights the global nature of our business reach and operational footprint:

For the year ended December 31, 2023, we generated revenue of $4,563.3 million (reflecting a 10.0% increase from $4,150.5 million for the year ended December 31, 2022), net loss of $35.1 million (reflecting a 67.1% increase from $21.0 million for the year ended December 31, 2022) and Adjusted EBITDA of $561.1 million (reflecting a 18.0% increase from $475.4 million for the year ended December 31, 2022). For the six months ended June 30, 2024, we generated revenue of $2,582.9 million (reflecting a 12.0% increase from $2,306.1 million for the six months ended June 30, 2023), net income of $8.6 million (from a net loss of $12.6 million for the six months ended June 30, 2023) and Adjusted EBITDA of $336.0 million (reflecting a 15.2% increase from $291.7 million for the six months ended June 30, 2023). Our history of net losses is mainly due to our substantial historical indebtedness as a private company, which as of June 30, 2024 totaled $3,275.7 million. As a result of our substantial indebtedness, a significant amount of our cash flows is required to pay interest and principal on our outstanding indebtedness.

Given the nature of engine maintenance and the structure of certain of our agreements, a significant portion of our costs of sales consists of new OEM materials that are included in the engines we service and are often passed through to end customers at minimal or no mark-up, impacting our reported margins.

Our value creation strategy includes a combination of organic growth initiatives on our existing platforms, pursuit of new platform programs, and investment in value-accretive acquisitions. For our existing business, we focus on developing new capabilities and on ways to continuously improve operational performance to enhance our competitiveness, accelerate growth and increase margins. Over the last five years, we have invested to significantly expand our engine component repair services business, which enjoys higher margins than and is synergistic with our engine services business. We have also invested to expand our capacity and competitiveness on the CFM56 platform, the largest engine platform in the world today, including establishing a new CFM56-dedicated Center of Excellence facility in Dallas, Texas to service the growing demand on that platform.

4

Table of Contents

Another significant pillar to our growth is the expansion into new engine platforms that create value for us and for our customers. Since 2016, we have been awarded licenses and authorizations and established capabilities on eight new platforms across our end markets. Most notably, in March 2023 we became the first and only independent aftermarket service provider in North America to join CFM International Inc.s (CFM) authorized service network for the LEAP-1A and LEAP-1B engines through the award of a long-term CFM Branded Service Agreement (CBSA). The LEAP-1A and LEAP-1B engines power the Airbus A320neo family and the Boeing 737MAX series aircraft, respectively, and are expected to become by far the largest engine platform family in the world, accounting for over 35% share of the worlds installed base of engines by 2033. We are one of only five total CBSA holders in the world, one of two global independent service providers, and the only independent service provider in the Americas with such a CBSA, which affords us significant competitive benefits and support from CFM, as well as the ability to develop and provide additional component repair on the engines that we service and to external parties. The CBSA has the potential to be the largest award in the Companys history, and we believe it positions us to achieve above-market growth as LEAP engines experience a significant ramp up in demand over the next decade and beyond.

Alongside this organic investment, over the past seven years we have successfully completed 11 strategic acquisitions. Our disciplined approach to evaluating and executing M&A focuses on companies that add strategic engine platforms, new capabilities and intellectual property, and reach into targeted customers and geographies where we have an opportunity to accelerate the growth and financial performance of the combined businesses. We have a proven playbook for integrating new acquisitions and achieving significant synergies, which has enabled us to acquire businesses at attractive valuations on a post-synergy basis. We operate in highly fragmented markets, which has historically provided ample acquisition opportunities to grow and enhance our platform and achieve compounding returns. On August 23, 2024, we completed our most recent acquisition through our purchase of Aero Turbine Inc. (Aero Turbine), a provider of engine component repair and other value-added engine aftermarket services for U.S. and international customers. The acquisition was funded with borrowings under the ABL Credit Facility, which was repaid on September 6, 2024 with incremental borrowings from the 2024 Term Loan B-1 Facility and the 2024 Term Loan B-2 Facility. Aero Turbine adds highly complementary component repair and source approval request (SAR) capabilities on strategic military platforms and generated revenues and net income of $70.1 million and $14.3 million, respectively, during the year ended December 31, 2023. We expect to report Aero Turbine within our Component Repair Services segment.

The Market for Engine Aftermarket Services

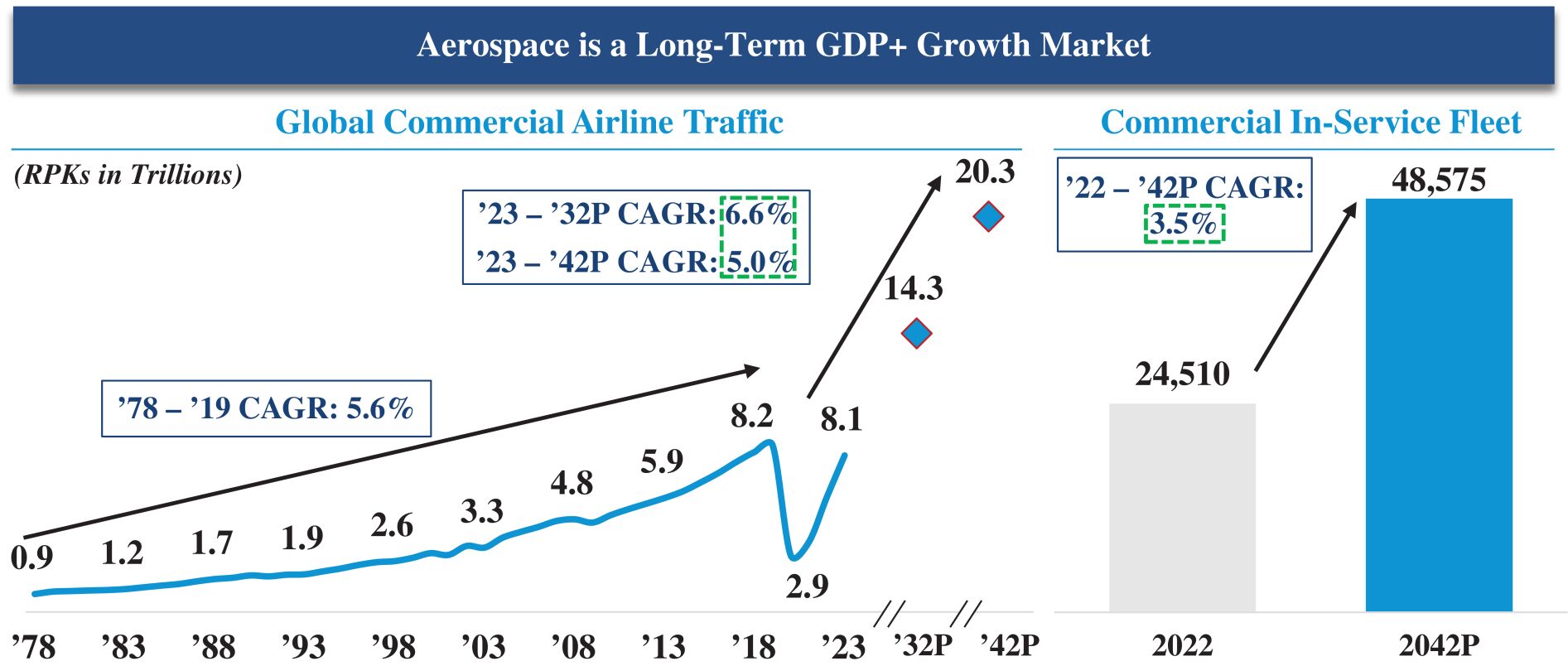

The global aerospace industry, spanning the commercial, military and business aviation sectors, has historically achieved growth in excess of GDP growth driven by secular tailwinds such as globalization, growing middle-class populations and wealth, increasing demand for leisure travel, growth in corporate earnings and technological advancements in aviation that make air travel more accessible.

Given this strong growth trajectory, a robust aerospace aftermarket is critical to support the global aircraft fleet. The aerospace aftermarket accounts for a significant portion of the total aerospace market and is expected to total over $250 billion in 2024. Within the aftermarket, one of the most crucial and fastest growing sub-segments is engine aftermarket services, which accounts for approximately 45% of the commercial aerospace aftermarket. The engine is one of the most expensive and critical components of an aircraft, requiring service at regular intervals to meet regulatory mandates and sustain required performance. As a result, aftermarket services for the engine require specialized expertise and advanced technology to ensure the reliability and efficiency of aerospace operations.

Engine aftermarket services include routine inspections and scheduled and unscheduled maintenance, repairs and overhauls to keep engines in optimal conditions. OEMs and regulatory bodies, including the FAA, set

5

Table of Contents

guidelines and regulatory requirements for engines to be considered airworthy, and engine aftermarket services tend to be highly predictable based on the utilization of an engine and the length of its time in service. Aircraft engines generally have a lifespan of 30 to 40+ years, during which they undergo multiple major maintenance events, referred to as shop visits, providing long and recurring revenue streams for aftermarket providers.

The engine services aftermarket has three types of participants: service divisions of engine OEMs, independent service providers and airline captive maintenance divisions. The main engine OEMs include GE Aerospace, CFM International, Pratt & Whitney, Rolls-Royce, Honeywell and Safran. While typically the focus of engine OEMs is to build new engines, produce spare parts for existing engines and develop next-generation platforms, OEMs also have divisions that provide service on their own engine platforms in order to support the installed base and generate technical insight into the performance of their engine models, particularly early in the platform lifecycle. Independent service providers like StandardAero are not affiliated with any one OEM or airline, are able to work on a wide range of engine platforms for many different customers and play a critical role in the ecosystem. Certain independent service providers receive authorizations to support specific engine platforms by the OEMs, who rely on them to build out a strong aftermarket network to support fleet customers. Some large commercial airlines, such as Delta, United and Lufthansa, maintain in-house service divisions that primarily focus on supporting aircraft and engine platforms flown by the affiliated airline. The majority of airlines do not have captive engine maintenance capabilities and depend upon third-party service providers for support.

Engine component repair services is a specialized and critical segment within the broader aerospace engine aftermarket. During the engine overhaul process, engines are disassembled into modules and piece parts that are then inspected. Damaged engine parts are then either replaced with new parts or repaired depending on the condition of the part and whether a repair is possible. Those repairs are either performed by the engine overhaul provider itself or outsourced to a specialized repair provider depending on the complexity of the repair and whether the overhaul provider has the necessary capability, equipment and intellectual property to perform the repair. We believe that demand for component repair services generally will grow in line with the broader engine aftermarket over the long-term. Part repairs often can be delivered more quickly than and at a significant discount to a new replacement engine part, resulting in a reduction in both cost and turnaround time for an engine overhaul and thereby creating value pricing opportunities that represent upside to market growth. The landscape of engine component repair providers is highly fragmented and includes the engine OEMs, airline captive maintenance operations and independent service providers. Often the most sophisticated and technically complex repairs are performed by the OEMs or certain independent service providers, like StandardAero, who are specifically authorized by the OEMs to perform them.

We primarily compete across three end markets within the engine aftermarket industry: commercial, military and helicopter, and business aviation.

Global commercial air traffic grew at a 5.6% CAGR over the last 40 years as well as over the 10 years ending in 2019 (prior to the COVID-19 pandemic), representing approximately twice the rate of global GDP growth over that timeframe. The global air traffic sector has demonstrated strong resiliency over the years, given that from 1978 through 2023 it only declined five times year-over-year and has never declined in consecutive years. The secular growth in air travel demand is expected to continue, driving the number of aircraft in service to increase by a 3.5% CAGR from 2023-2042, supported by record commercial aircraft OEM backlog levels. Additionally, the average age for the commercial fleet has increased to approximately 12 years in 2023 versus approximately 10 years in the early 2010s, and a slower than expected schedule of OEM deliveries has extended the average life of the existing fleet and increased the associated requirements for maintenance services. Approximately 9,000 shop visits and engine overhauls are anticipated in 2024, as the aviation sector gears up for an era of extended asset lives. Further, much of the maintenance that was deferred during the COVID-19 pandemic is coming due and can no longer be delayed, supporting additional growth in the aftermarket. Engine aftermarket services demand is also expected to increase materially through the remainder of the decade with a wave of upcoming shop visits, which is a function of a large number of engines delivered in the 2010s continuing to age and entering prime maintenance periods. For example, the CFM56 engine platform, which represents the

6

Table of Contents

largest engine platform fleet today with over 19,000 engines in-service as of June 2024, of which approximately 45% have yet to have experienced their first heavy shop visit, is expected to see significant growth in scheduled maintenance over the next several years. Additionally, many LEAP-1A/-1B engines, which were first delivered in 2016, have only recently started coming in for their first maintenance events. The LEAP platform is poised to become the largest engine platform globally (expected to comprise approximately 30,000 engines, representing over 35% of global fleet by 2033). As these new engines are introduced into the market, they will enter predictable and recurring maintenance cycles, boosting demand for engine aftermarket services.

In the military and helicopter end market, ongoing geopolitical tensions continue to drive significant defense investment. The global military aviation aftermarket is projected to grow by approximately 2-3% in 2024 with the U.S. accounting for approximately 40% of global military spend. Amid evolving security challenges, aftermarket service providers are critical to ensuring readiness of defense forces globally. Sustainment remains a priority for the U.S. Department of Defense, with mission-readiness rates of military aircraft at record low levels of approximately 55%, as of the most recent study by the U.S. Government Accountability Office. Additionally, the COVID-19 pandemic and uncertain budgetary environments caused delays to the modernization of military aircraft fleets, resulting in a globally aging military aircraft fleet that requires higher levels of maintenance and an influx of aircraft upgrades and life extension programs.

In the business aviation end market, the COVID-19 pandemic accelerated a shift to private aviation, initially triggered by health and safety concerns and limited availability of commercial flights. While demand for private air travel has grown over the past five years (2023 business jet flight operations were 15% higher than 2019), aircraft manufacturing has not kept pace, with the global business jet fleet growing only 7% during that time. As a result, fleet utilization has increased significantly and the market has shifted from private aircraft towards charter and fractional aircraft owned by fleet operators, with fractional and charter flights representing 59% of U.S. business jet flights 2023 (up from 48% in 2010). The surge in activity and overall demand for business aviation has driven strong backlogs and production outlooks at the business jet OEMs, with deliveries estimated to grow approximately 20% by 2027, which underpins an outlook for sustained long term growth of the fleet. This strong fleet growth is expected to drive a continued increase in demand for business jet engine maintenance services.

Challenges

Our business is subject to a number of risks inherent to the commercial, military and helicopter, and business aviation end markets, including, among others, supply chain delays, which have in recent years impacted the availability of parts and ultimately engine throughput across all of our end markets and can cause significant production and delivery delays to any new or expanded product or engine platforms and affect our ability to provide aftermarket support and services to our customers; decreases in budget, spending or outsourcing by our military end users; and increased costs of labor, equipment, raw materials, freight and utilities due to inflation, which we have experienced in recent years. Any number of these and other factors could impact our business, and there is no guarantee that our historical performance will be predictive of future operational and financial performance. For a description of the challenges we have faced and continue to face and the risks and limitations that may prevent us from achieving our business objectives or that may adversely affect our business, financial condition, results of operations, cash flows and prospects, see Cautionary Note Regarding Forward-Looking Statements, Summary of Risk Factors, Risk Factors and Managements Discussion and Analysis of Financial Condition and Results of OperationsKey Factors and Trends Affecting Our Business included elsewhere in this prospectus.

Our Competitive Strengths

We believe the following strengths differentiate us from our competitors, enable us to profitably grow our leading positions in each of our end markets and drive our continued success.

7

Table of Contents

Leading Independent Pure-Play Service Provider with Strategic Focus on the Aerospace Engine Aftermarket

Within the broader aerospace market, we are strategically focused on the aerospace engine aftermarket, which we believe is the largest and most attractive vertical of the aerospace aftermarket, characterized by its long tail of predictable and recurring revenue, as well as high technical complexity that affords significant competitive advantages and higher levels of profitability to scaled, capable and reputable providers. We believe that we are the largest independent, pure-play engine aftermarket services provider in the world. We provide critical aftermarket support to many of the most prolific engine platforms for fixed and rotary wing aircraft in the commercial, military and business aviation end markets. Our comprehensive suite of services includes scheduled and unscheduled engine maintenance, repair and overhaul, engine component repair, on-wing and field service support, asset management and engineering solutions. Our primary competitors include in-house service divisions of airlines, engine OEMs and other third-party service providers for whom engine aftermarket services is only a portion of their business, and we believe we are able to utilize our pure-play focus to guide our strategy and resources to best position our business to succeed within our attractive vertical.

Scaled Presence and World-Class Capabilities Built Through Decades of Investment

We believe our leading position in the aerospace industry is underpinned by our exceptional track record of past performance, our scaled global footprint and the extensive procedures and expertise we have developed and implemented over decades to ensure safety and reliability throughout our operations. Performing aerospace engine maintenance requires highly specialized technical expertise and is often supported by deep intellectual property and significant investment of time and resources to secure the necessary infrastructure, tooling and skilled engineering know-how. New entrants must obtain approvals and certifications from OEMs, customers and government regulators and must develop and demonstrate conformity with sophisticated production, quality and materials tracking systems. Additionally, OEM services authorizations are often difficult to obtain and require advanced technological capabilities, experience-based industry knowledge and substantial capital investment, and are typically awarded by OEMs for each engine platform separately. As of June 2024, we operate over 50 facilities with 54 test cells globally, which would require substantial capital investment to replicate. We employ approximately 7,300 highly skilled employees and maintain OEM licenses and authorizations that allow us to service over 40 distinct engine platforms. Furthermore, our extensive engine component repair capabilities allow us to reduce turnaround times and costs for customers, significantly enhancing our value proposition.

Longstanding Customer Relationships with Leading, Entrenched Positions on Critical Engine Platforms

Efficient completion of maintenance and repairs in a comprehensive and timely manner is a significant focus of aircraft operators and OEMs alike. Over our 100+ year history, we have developed multi-decade relationships with hundreds of customers, which include the largest global and regional aircraft operators across the commercial, military and helicopter, and business aviation end markets. We believe these customers choose StandardAero due to our exemplary track record of safety, quality, high reliability, performance and knowledgeable technical support.

We maintain equally strong relationships with and are a trusted partner to every top aerospace engine OEM, including GE Aerospace, CFM International, Pratt & Whitney, Rolls-Royce, Honeywell and have obtained long-term OEM licenses and authorizations to provide aftermarket support for all of the engine platforms that we service. These licenses and authorizations provide us access to OEM technical data, technical support and training, and often favorable commercial terms. Once awarded, we believe we have a 100% historical success rate on the OEM licenses and authorizations we sought to retain upon their expiration.

We have leveraged our relationships, track record and scale to build market leading positions on the platforms that we service. We estimate that 80% of our Engine Services sales in 2023 were derived from our work on engine platforms where we hold #1 or #2 positions globally. Additionally, we hold exclusive or semi-exclusive licenses directly with the OEM as the only independent service provider in North America officially

8

Table of Contents

authorized to service a number of our platforms, including the Rolls-Royce RB211-535, AE 1107, AE 2100 and AE 3007 and the Honeywell HTF7000, and are the only independent service provider in the Americas to hold an official CBSA license from CFM International on the LEAP-1A and LEAP-1B engines.

Our deep customer relationships, supported by long-term contractual agreements, also underpin the visibility and growth of our business model. For the year ended December 31, 2023, approximately 77% of our revenue was derived from long-term contractual agreements. Of our remaining transactional business, a significant portion stems from repeat customers or single aircraft operators who dont have the scale or sophistication to enter into long-term service agreements with third parties. We believe our highly responsive customer and technical support, quality work, track record of consistent on-time delivery and post-overhaul product reliability have driven exceptional customer retention.

Proven Playbook to Capture and Execute New Platform Opportunities

We have a strong track record of successfully cultivating or acquiring access to new platforms, customers and geographies. Since 2016, we have been awarded OEM licenses and authorizations for eight unique engine programs and have developed approximately 2,500 new component repairs. Once awarded, we have a proven process to complete necessary industrialization and induct engines at what we believe to be industry leading efficiency. In October 2023, we received FAA Operations Specifications approval for our new LEAP engine line, six months after receiving our CBSA license and three months ahead of schedule. In 2021, after receiving a major new platform award for the J85 engine from the US Air Force (USAF), we rapidly stood-up a dedicated team at our San Antonio facility and correlated USAF Gold rated J85 test cells within 10 months of our initial contract award. We believe our commercial excellence culture coupled with our predictive analytics model will enable an approximate 25% increase in time on wing for the J85 engine and a significant increase in throughput of engines each month. This proven track record of successful operation and execution provides us significant credibility with OEMs when discussing new platforms. We remain in constant dialogue with every major OEM and continuously evaluate our pipeline for attractive new engine platform industrialization opportunities.

Resilient Business Model Highly Diversified Across Segments of the Aerospace Engine Aftermarket

We are focused on the aerospace engine aftermarket, which is highly resilient and driven by strict OEM and regulatory requirements for the inspection and maintenance of aircraft engines across their well-defined lifecycle phases. The complex and recurring nature of our engine repair work on behalf of our customers precipitates the use of long-term contracts to secure slot availability and pricing terms, which further contributes to the predictable and recurring nature of our revenue.

In addition, our business is well diversified across commercial, military and business aviation markets. We operate with OEM licenses and authorizations that allow us to service over 40 engine platforms, with the largest engine platform accounting for over 10% of our Engine Services revenue in both the six months ended June 30, 2024 and the year ended December 31, 2023. We maintain a strong reputation with all OEMs, longstanding relationships with a large and diverse customer base and leading market positions on most platforms that we service, all of which contribute to the stability of our business model. Our business is further insulated by our flexible cost structure, which allows us to scale up and down our operations to reflect market demand. Our primary expenses are comprised of engine materials (a significant portion of which is pure passthrough with minimal mark-up) and value-added labor, both of which are variable and provide through-the-cycle margin protection. The resiliency of our well-diversified business was on full display during the COVID-19 pandemic.

Ability to Execute and Integrate Acquisitions in a Highly Fragmented Industry

We maintain a rigorous approach to M&A and actively maintain a robust pipeline of actionable opportunities. We expect our disciplined acquisition strategy and integration playbook will continue to be a key driver in growing our revenue by expanding our capabilities, engine platforms and geographic footprint. Complementing our organic growth, we have completed 11 value-enhancing acquisitions since 2017, each

9

Table of Contents

expanding our reach through the addition of new engine platforms, customers, capabilities, or geographies. Most recently, on August 23, 2024, we acquired Aero Turbine, a provider of engine component repair and other value-added engine aftermarket services that adds highly complementary component repair and SAR capabilities and expertise on strategic military platforms.

Premier Management Team with a Track Record of Success

Our premier management team, led by Chief Executive Officer & Chairman Russell Ford, has extensive managerial, operational and financial experience. Our leadership team has a proven track record of expanding our portfolio of aeroengine aftermarket programs and capabilities, strengthening our relationships with key OEMs and customers, implementing operational initiatives to drive lower costs for our customers and increasing profitability for our stockholders. We believe our established culture of safety and continuous improvement, our track record of operational success and our clearly defined strategy for organic and inorganic-driven growth position us for significant further earnings growth.

Our Growth Strategies

Our core strategy is to continue to build on our position as the leading independent, pure-play engine aftermarket services provider for commercial, military and business aircraft with best-in-class component repair capabilities. Our continued success in driving above-market growth across each of these end markets is built upon the following strategies:

Leverage Strategic Investments to Capitalize on Market Tailwinds and Capture Share on High-Growth Platforms

We have invested significantly to expand our capacity and build out our core engine maintenance capabilities. We believe this investment will enable us not only to meet the robust demand growth expected in the aerospace engine aftermarket but also to capture share on the engine platforms that we serve, particularly the CFM56-7B and the LEAP-1A/-1B. The CFM56 is the most prolific engine platform in the world today, with over 19,000 engines in service powering all Boeing 737NG and approximately 60% of Airbus A320ceo family of aircraft. We have invested over $100 million since 2022 to expand our capabilities and more than double our shop visit capacity on the CFM56-7B engine through a new greenfield CFM56 Center of Excellence in Dallas, Texas. These investments have positioned us to capture significant share on the CFM56 platform as maintenance events visits are expected to significantly ramp into 2025 and beyond. We are currently investing over $100 million to position ourselves as a leader on the growing LEAP-1A/-1B platform which is expected to overtake the CFM56 as the worlds most widely fielded engine platform over the next decade and account for over 35% the global installed base by 2033. We believe we are uniquely positioned to capture outsized share on this high-growth platform as the only independent CBSA license holder in the Americas.

In addition, we have invested over $500 million since 2017 to scale our Component Repair Services business into one of the largest independent engine component repair businesses worldwide, developing approximately 2,000 new repairs and significantly expanding our capability offering organically and through targeted acquisitions. We plan to continue leveraging our component repair expertise to strengthen the value proposition of our Engine Services business by reducing costs and improving turnaround times while also growing third-party repair sales which are highly accretive to our overall enterprise. We believe we are in the early innings of realizing the growth potential of these recent strategic investments.

Execute on Identified Performance Excellence Initiatives

Continuous improvement is fundamental to our business model and our corporate culture. We frequently review opportunities to deliver our quality repair services at a lower total cost to our customers, improve our

10

Table of Contents

shop visit turnaround times and drive increased profitability. We have identified opportunities to advance these goals through increased insourcing of our external repair spend, a systematic and formalized adoption of value-based pricing, increased utilization of Used Serviceable Material (USM) and other strategic sourcing initiatives. We expect these performance enhancement initiatives and similar actions will continue to drive improved profitability and outcomes for our customers.

Capitalize on OEM Relationships to Win New Engine Programs

We believe there is large and growing demand for the engine aftermarket and engine component repair services we provide. This growth will enable us to leverage our reputation as a trusted partner and independent industry leader to enter into new authorizations with OEMs on future engine programs. We engage regularly in dialogue with OEMs and evaluate each licensing opportunity in a disciplined and differentiated manner. Our approach is focused on ensuring high conviction of generating an attractive return on our investment with a structured new platform introduction process to mitigate execution risk. Since 2016, we have been awarded licenses and authorizations for eight engine programs. We intend to continue to leverage our premier reputation and credibility with OEMs to continue to grow the number of engine platforms that we service, further diversifying our sources of revenue and profitability.

Drive Additional Value Creation Through M&A

M&A is a core tenant of our value creation playbook. We maintain a robust pipeline of M&A opportunities, evaluate dozens of potential acquisitions each year and have completed 11 highly complementary acquisitions since 2017. Through these acquisitions, we have successfully added new platforms, customers, capabilities and intellectual property and have expanded our geographic footprint. We have a systematic integration process that we employ to support our track record of successful integration, seamless onboarding of new facilities, customers and engine programs and realization of significant synergies with our existing business. We believe our markets are highly fragmented with many attractive opportunities for continued acquisitions. We also believe that our market presence, scale and expertise in establishing and executing engine aftermarket services makes us an attractive joint venture partner, particularly in emerging markets which require capital and expertise to capitalize on significant growth opportunities. We intend to continue to pursue growth via M&A, evaluating each opportunity within our existing strategic framework, with focus on long-term equity value appreciation.

Summary Risk Factors

We are subject to a number of risks, including risks that may prevent us from achieving our business objectives or that may adversely affect our business, financial condition, results of operations, cash flows and prospects. You should carefully consider the risks discussed in the section entitled Risk Factors included elsewhere in this prospectus, including the following risks, before investing in our common stock:

| | risks related to conditions that affect the commercial and business aviation industries; |

| | decreases in budget, spending or outsourcing by our military end-users; |

| | risks from any supply chain disruptions or loss of key suppliers; |

| | increased costs of labor, equipment, raw materials, freight and utilities due to inflation; |

| | future outbreaks and infectious diseases; |

| | risks related to competition in the market in which we participate; |

| | loss of an OEM authorization or license; |

| | risks related to a significant portion of our revenue being derived from a small number of customers; |

11

Table of Contents

| | our ability to remediate effectively the material weaknesses identified in our internal control over financial reporting; |

| | our ability to respond to changes in GAAP; |

| | our or our third-party partners failure to protect confidential information; |

| | data security incidents or disruptions to our IT systems and capabilities; |

| | our ability to comply with laws relating to the handling of information about individuals; |

| | failure to maintain our regulatory approvals; |

| | risks relating to our operations outside of North America; |

| | failure to comply with government procurement laws and regulations; |

| | any work stoppage, hiring, retention or succession issues with our senior management team and employees; |

| | any strains on our resources due to the requirements of being a public company; |

| | risks related to our substantial indebtedness; |

| | risks related to this offering and ownership of our common stock, including the fact that, after completion of this offering, we are expected to be a controlled company; and |

| | other factors set forth under Risk Factors elsewhere in this prospectus. |

Our Principal Stockholders

Our principal stockholders are certain investment funds affiliated with Carlyle and GIC. Founded in 1987, Carlyle is a global investment firm with deep industry expertise that deploys private capital across its business across three business segments: Global Private Equity, Global Credit and Global Investment Solutions. With $435 billion of assets under management as of June 30, 2024, Carlyles teams invest across a range of strategies that leverage its deep industry expertise, local insights and global resources to deliver attractive returns throughout an investment cycle. Carlyle employs more than 2,200 people in 29 offices across four continents.

Carlyle is a leading private equity investor in the aerospace, defense and government services sectors, having completed approximately 46 transactions representing approximately $12.3 billion in equity invested since inception.

GIC is a leading global investment firm established in 1981 to manage Singapores foreign reserves. A disciplined long-term value investor, GIC is uniquely positioned for investments across a wide range of asset classes, including equities, fixed income, private equity, real estate and infrastructure. In private equity, GIC invests through funds as well as directly in companies, partnering with its fund managers and management teams to help world class businesses achieve their objectives. GIC has investments in over 40 countries and has been investing in emerging markets for more than two decades. Headquartered in Singapore, GIC employs over 2,300 people across 11 offices in key financial cities worldwide.

Following the consummation of this offering, Carlyle will continue to control a majority of the voting power of our outstanding common stock. Accordingly, Carlyle will control us and will have, among other things, the ability to approve or disapprove substantially all transactions and other matters requiring approval by stockholders, including the election of directors. You should consider that the interests of Carlyle may differ from your interests in material respects, and they may vote in a way with which you disagree and that may be adverse to your interests. See Risk FactorsRisks Related to this Offering and Ownership of Our Common Stock for more information.

12

Table of Contents

Corporate Structure and Restructuring Transactions

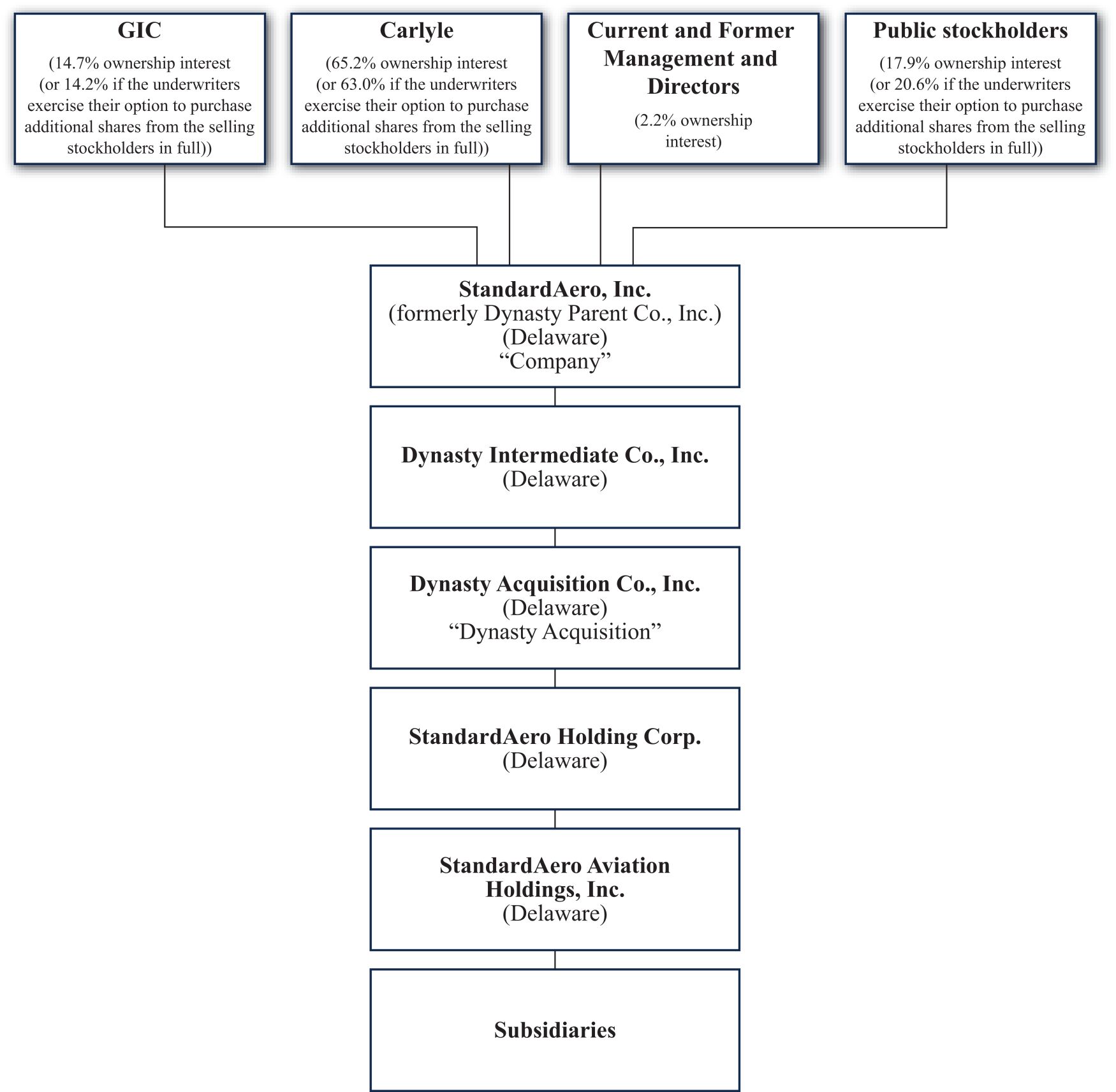

In connection with and prior to the completion of this offering, we and our immediate parent, Dynasty Parent Holdings, L.P., have effected and will effect certain restructuring transactions, which we refer to collectively as the Restructuring Transactions. The Restructuring Transactions consist of (i) the 103-for-one forward stock split of our common stock effected on September 20, 2024, (ii) the liquidation and dissolution of Dynasty Parent Holdings, L.P. to be effected prior to the completion of this offering and (iii) the distribution to holders of Class A-1 Units and Class A-2 Units of Dynasty Parent Holdings, L.P. an aggregate of 275,597,623 shares of our common stock (of which 8,172 will be restricted shares), and to holders of Class B Units of Dynasty Parent Holdings, L.P. an aggregate of 5,614,007 restricted shares of our common stock, in each case based on an assumed initial public offering price of $21.50 per share (the midpoint of the price range set forth on the cover of this prospectus). Immediately following the Restructuring Transactions, 281,211,630 shares of our common stock will be issued and outstanding. Following the Restructuring Transactions, upon completion of this offering, Carlyle and GIC will own approximately 65.2% and 14.7% of our outstanding common stock, respectively, or approximately 63.0% and 14.2%, respectively, if the underwriters exercise their option to purchase additional shares from the selling stockholders in full.

13

Table of Contents

The following chart summarizes our corporate structure immediately following this offering. This chart is provided for illustrative purposes only and does not represent all legal entities affiliated with, or all subsidiaries of, the Company:

In connection with this offering, we expect to enter into the Stockholders Agreement with Carlyle Partners VII, the GIC Investor, and certain of our other existing stockholders who are currently party to the Partnership Agreement. For a description of the Stockholders Agreement, see Certain Relationships and Related Party TransactionsRelated Party TransactionsPartnership Agreement and Stockholders Agreement.

Our Corporate Information

StandardAero, Inc. is the issuer in this offering and is a Delaware corporation incorporated on September 5, 2018. Our principal executive office is located at 6710 North Scottsdale Road, Suite 250, Scottsdale, AZ 85253, our phone number is + 1 (480) 377-3100 and our website is www.standardaero.com. We have included our website address in this prospectus as an inactive textual reference only. The information contained on, or that can be accessed through, our website is not a part of, and should not be considered as being incorporated by reference into, this prospectus.

14

Table of Contents

THE OFFERING

| Common stock offered by us |

53,250,000 shares. |

| Common stock offered by the selling stockholders |

6,750,000 shares. |

| Selling stockholders |

The selling stockholders identified in Principal and Selling Stockholders. |

| Common stock to be outstanding after this offering |

334,461,630 shares. |

| Option to purchase additional shares from the selling stockholders |

The underwriters have been granted an option to purchase up to an aggregate of 9,000,000 additional shares of common stock from the selling stockholders. The underwriters can exercise this option at any time within 30 days from the date of this prospectus. |

| Use of proceeds |

We estimate that the net proceeds to us from this offering, after deducting underwriting discounts and estimated offering expenses, will be approximately $1,075.0 million, based on the assumed initial public offering price of $21.50 per share, which is the midpoint of the price range set forth on the cover page of this prospectus. |

| We intend to use the net proceeds from this offering (i) first, to redeem all $475.5 million aggregate principal amount of the Senior Notes outstanding, at a redemption price equal to 100% of the aggregate principal amount thereof and (ii) the remainder to prepay approximately $432.7 million aggregate principal amount of the 2024 Term B-1 Loans and approximately $166.8 million aggregate principal amount of the 2024 Term B-2 Loans, with such amounts increased or reduced on a pro rata basis to the extent our actual net proceeds are higher or lower, respectively, than our estimated net proceeds. We expect to use current cash and cash equivalents to pay any accrued interest owed in connection with the redemption of the Senior Notes and the prepayment of a portion of the 2024 Term B-1 Loans and 2024 Term B-2 Loans. We will not receive any proceeds from the sale of common stock by the selling stockholders, including from any exercise by the underwriters of their option to purchase additional shares. See Use of Proceeds. |

| Each $1.00 increase (decrease) in the assumed initial public offering price of $21.50 per share, which is the midpoint of the price range set forth on the cover page of this prospectus, would increase (decrease) the net proceeds to us from this offering by $50.5 million, assuming the number of shares of common stock offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the assumed underwriting discounts and commissions and estimated offering expenses payable by us. Each increase (decrease) of 1,000,000 shares of common stock from the expected number of shares of common stock to be sold by us in this offering, assuming no change in the assumed initial public offering price per share, which is the midpoint of the price range set forth on the cover page of this |

15

Table of Contents

| prospectus, would increase (decrease) our net proceeds from this offering by $20.4 million. |

| Conflicts of interest |

Affiliates of Carlyle beneficially own in excess of 10% of our issued and outstanding common stock and certain Carlyle affiliated funds may receive 5% or more of the net proceeds of the offering as selling stockholder. Because TCG Capital Markets L.L.C., an affiliate of Carlyle, is an underwriter, this offering is being made in compliance with the requirements of Rule 5121 of the Financial Industry Regulatory Authority, Inc. (FINRA). Pursuant to that rule, the appointment of a qualified independent underwriter is not required in connection with this offering as TCG Capital Markets L.L.C. is not primarily responsible for managing this offering. TCG Capital Markets L.L.C. will not confirm sales of the securities to any account over which it exercises discretionary authority without the specific written approval of the account holder. See Underwriting (Conflicts of Interest). |

| Proposed stock exchange symbol |

SARO |

| Controlled company |

Following this offering, we will be a controlled company within the meaning of the corporate governance rules of the NYSE. After the consummation of this offering, Carlyle will continue to control us and have, among other things, the ability to approve or disapprove substantially all transactions and other matters requiring approval by stockholders, including the election of directors. |

| Dividend policy |

We currently do not intend to declare any dividends on our shares of common stock in the foreseeable future. Our ability to pay dividends on our shares may be limited by the covenants contained in the agreements governing our outstanding indebtedness and applicable law. See Dividend Policy. |

| Indication of interest |

The cornerstone investors have, severally and not jointly, indicated an interest in purchasing up to an aggregate of $275 million in shares of our common stock in this offering at the initial public offering price. The shares to be purchased by the cornerstone investors will not be subject to a lock-up agreement with the underwriters. Because this indication of interest is not a binding agreement or commitment to purchase, the cornerstone investors may determine to purchase more, less or no shares in this offering or the underwriters may determine to sell more, less or no shares to the cornerstone investors. The underwriters will receive the same discount on any of our shares of common stock purchased by the cornerstone investors as they will from any other shares sold to the public in this offering. |

| Risk factors |

Investing in our common stock involves a high degree of risk. See Risk Factors beginning on page 21 of this prospectus for a discussion of factors you should carefully consider before investing in our common stock. |

The number of shares of common stock to be outstanding after this offering excludes:

| | 19,662,698 shares of common stock that will become available for future issuance under the 2024 Incentive Award Plan (the 2024 Plan), which will become effective in connection with the completion of this offering; |

16

Table of Contents

| | 6,554,233 shares of common stock that will become available for future issuance under the 2024 employee stock purchase plan (the ESPP), which will become effective in connection with the completion of this offering; and |

| | 464,115 shares of common stock issuable upon the exercise of options outstanding under the Prior Plan as of September 23, 2024 with a weighted average exercise price of $10.49 per share. |

The number of shares of common stock to be outstanding after this offering includes the 5,622,179 unvested restricted shares of common stock to be issued in connection with the Restructuring Transactions in exchange for unvested Class A-2 Units and Class B Units outstanding under the Dynasty Parent Holdings, L.P. and StandardAero, Inc. 2019 Long-Term Incentive Plan (the Prior Plan) as of September 23, 2024.

Unless otherwise indicated, all information contained in this prospectus:

| | assumes an initial public offering price of $21.50 per share, which is the midpoint of the price range set forth on the cover page of this prospectus; |

| | assumes no exercise by the underwriters of their option to purchase up to 9,000,000 additional shares from the selling stockholders; |

| | assumes the completion of the Restructuring Transactions; and |

| | gives effect to our amended and restated certificate of incorporation and our amended and restated bylaws. |

17

Table of Contents

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL INFORMATION

The following tables set forth our summary historical consolidated financial information as of June 30, 2024 and December 31, 2023 and 2022, and for the six months ended June 30, 2024 and 2023, and the fiscal years ended December 31, 2023, 2022 and 2021.

The summary historical consolidated statements of operations and summary historical consolidated statements of cash flow data presented below for the six months ended June 30, 2024 and 2023 and the historical consolidated balance sheet data as of June 30, 2024 presented below were derived from the unaudited condensed consolidated interim financial statements and the related notes thereto, included elsewhere in this prospectus. The summary historical consolidated statements of operations data and summary historical consolidated statements of cash flow data presented below for the years ended December 31, 2023, 2022 and 2021 and the consolidated balance sheet data as of December 31, 2023 and 2022 have been derived from, and should be read together with, our audited consolidated historical financial statements and the accompanying notes included elsewhere in this prospectus.

This information is a summary only and should be read in conjunction with Risk Factors, Capitalization, Dilution, Managements Discussion and Analysis of Financial Condition and Results of Operations and our consolidated financial statements and the accompanying notes included elsewhere in this prospectus.

Our historical results are not necessarily indicative of results to be expected in future periods.

| Six Months Ended June 30, | Year Ended December 31, | |||||||||||||||||||

| 2024 | 2023 | 2023 | 2022 | 2021 | ||||||||||||||||

| (in millions, except share and per share data) | ||||||||||||||||||||

| Consolidated statements of operations data: |

||||||||||||||||||||

| Revenue |

$ | 2,582.9 | $ | 2,306.1 | $ | 4,563.3 | $ | 4,150.5 | $ | 3,479.9 | ||||||||||

| Cost of revenue |

2,216.9 | 1,980.2 | 3,928.0 | 3,604.8 | 3,063.4 | |||||||||||||||

| Selling, general and administrative expenses |

108.8 | 95.2 | 202.8 | 188.1 | 156.4 | |||||||||||||||

| Amortization of intangible assets |

46.6 | 46.5 | 93.7 | 93.7 | 94.0 | |||||||||||||||

| Acquisition related costs |

| 1.5 | 1.5 | 1.3 | 8.4 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income |

210.6 | 182.7 | 337.4 | 262.6 | 157.7 | |||||||||||||||

| Interest expense |